In the previous lessons, we went through a variety of trading styles.

Hopefully, you can identify which one may match you the best.

If you already forgot what trading style is, fortunately, for you, it’s time to review!

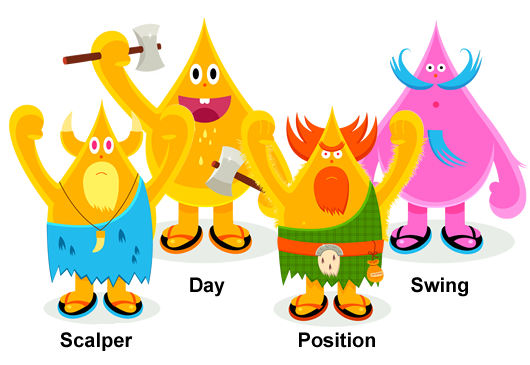

There are four main types of trading styles:

1. Scalping

Scalping is a fast-paced trading style where traders aim to profit from small price movements by executing numerous short-term trades throughout the day.

Scalpers typically hold positions for a few seconds to a few minutes and rely on technical analysis to identify entry and exit points.

Their main objective is to grab very small amounts of pips as many times as they can throughout the busiest times of the day.

2. Day Trading

Day trading is a style where traders open and close positions within the same trading day.

Day traders may use a mix of technical and fundamental analysis to capitalize on intraday price fluctuations.

Day traders usually pick a side at the beginning of the day, acting on their bias, and then finishing the day with either a profit or a loss. These kinds of traders do not hold their trades overnight.

3. Swing Trading

Swing trading is a style that involves holding positions for several days to a few weeks, seeking to profit from short to medium-term price trends.

Swing traders may use a combination of technical and fundamental analysis to identify potential entry and exit points.

These types of traders can’t monitor their charts throughout the day so they dedicate a couple of hours to analyzing the market every night to make sound trading decisions.

4. Position Trading

Position trading is a long-term approach where traders hold positions for weeks, months, or even years, aiming to capitalize on significant price trends.

Position traders primarily rely on fundamental analysis to identify undervalued or overvalued assets, with technical analysis serving as a secondary tool.

These traders know that fundamental themes will be the predominant factor when analyzing the markets and therefore make their trading decisions based on them.

Summary

Identifying your trading style is a crucial step toward developing a personalized trading strategy that complements your strengths and preferences.

No matter what style you choose, you have to make sure that it truly fits your personality.

By understanding and embracing your preferred approach, you can create a sustainable and consistent plan that increases your chances of success in the markets.

Always changing your trading style can lead to trouble and is a surefire way to blow your account.That said, if you try scalping and you realize after a week that it’s too fast or too draining, then be flexible enough to switch it up.

There is no one-size-fits-all solution in trading, and the key to long-term success lies in self-awareness, continuous learning, and adaptation.